How Many Times Can You Take the Cpa Exam

Are y'all request the question of how to become Subsidized Loans For Grad School? Well the answer is right her on Collegelearners while answering questions like Types of Federal Loans for Graduate School,Can you go a parent PLUS loan for graduate schoolhouse?,How much money can y'all get for graduate school? and so on

How Hard is the

CPA Exam in 2020?

What you'll learn here:

How hard is the CPA Exam, really?

• How many times can you take the CPA Exam?

What makes the CPA Exam then hard?

• What is the hardest function of the CPA Exam?

• What is the hardest section of the CPA Exam?

• Sample CPA Test questions

• What is the hardest type of question on the CPA Exam?

How time makes the CPA Exam hard

• What if I don't pass in 18 months?

• How long is the CPA Exam?

• How long does information technology take to pass the CPA Exam?

Why is the CPA Exam and so hard?

• History of the CPA Exam

• Purpose of the CPA Test

• Changes in the field of accounting

Yes, the CPA Exam is hard. But that doesn't mean you lot can't pass information technology!

How hard is the CPA Exam, really?

Hard may be an understatement. CPA Test pass rates hover slightly below 50%. This makes passing the CPA Exam a difficult, only achievable, goal—an achievement to exist proud of. You'll demand to study wisely, fix a strategy for managing your time, and call on your support network.

The CPA Exam is hard, merely with the correct program and good study materials, you volition conquer it.

How many times can you take the CPA Examination?

The AICPA does not have a limit on the number of times you may take the CPA Exam. And with a laissez passer rate of ~fifty%, steep exam requirements, and regularly updating materials, many candidates will notice themselves taking one or more than sections multiple times on their path to the CPA certification.

What makes the CPA Exam so hard?

The CPA Test is so difficult because:

The exam covers a variety of topics at different skill levels.

It tests the topics using multiple question types, including some question types that simulate existent-world tasks CPAs are expected to exercise.

Each department is timed.

Yous accept a limited amount of time (18 months from when y'all laissez passer your first department) to pass all four sections.

What is the hardest role of the CPA Exam?

The hardest topic on the CPA Test is going to vary depending on your groundwork. While many candidates detect government accounting to exist the most hard, you may consider property transactions or consolidated entities to be the almost challenging, for example.

Ultimately, it isn't whatsoever one topic that makes the CPA Examination difficult—it's the sheer scope of the exam in its entirety. The CPA Exam has 18 content areas divided into four sections. Inside those content areas are approximately 600 representative tasks. Each task represents a key cognition or skill required of CPAs, and these tasks are judged at different difficulties.

Circuitous structure

The CPA Exam is divided into the post-obit four sections:

Auditing and Attestation (AUD)

Business organization Environment and Concepts (BEC)

Financial Bookkeeping and Reporting (FAR)

Regulation (REG)

The four sections have their own content areas, and each content area makes up a dissimilar pct of that section's exam. While some sections have more content areas than others, the number of content areas does non directly lucifer the number of topics a section covers. For instance, BEC has 5 content areas but only around lxx tasks, whereas FAR has 4 content areas and nearly 200 tasks.

THE SOLUTION

Gleim CPA Review takes all the approximate piece of work out of the representative tasks.

Each question and simulation in our test bank has been crafted to test different tasks at their respective knowledge levels. And our SmartAdapt™ applied science will monitor your progress on each of these content areas and ensure yous run across the materials you need to meet to exist prepared on exam day.

The content areas for each section are:

| AUD Content around 160 Representative Tasks | ||

|---|---|---|

| Surface area | Percent | TASKS* |

| Ideals, Professional Responsibilities, and General Principles | 15-25% | xl |

| Assessing Risk and Developing a Planned Response | 20-30% | 45 |

| Performing Further Procedures and Obtaining Prove | xxx-40% | 40 |

| Forming Conclusions and Reporting | fifteen-25% | 35 |

| FAR Content around 195 Representative Tasks | ||

|---|---|---|

| Expanse | Pct | TASKS* |

| Conceptual Framework, Standard-Setting, and Financial Reporting | 25-35% | 55 |

| Select Fiscal Statement Accounts | xxx-40% | 60 |

| Select Transactions | xx-30% | 40 |

| Country and Local Governments | 5-xv% | 40 |

| BEC Content around 75 Representative Tasks | ||

|---|---|---|

| Surface area | PERCENTAGE | TASKS* |

| Corporate Governance | 17-27% | 15 |

| Economical Concepts and Analysis | 17-27% | 10 |

| Financial Management | 11-21% | 20 |

| Data Engineering science | fifteen-25% | xv |

| Operations Management | 15-25% | 15 |

| REG Content around 185 Representative Tasks | ||

|---|---|---|

| AREA | PERCENTAGE | TASKS* |

| Ethics, Professional person Responsibilities, and Federal Tax Procedures | 10-xx% | 20 |

| Business Police force | 10-20% | 35 |

| Federal Tax of Property Transactions | 12-22% | 30 |

| Federal Tax of Individuals | 15-25% | 20 |

| Federal Taxation of Entities | 28-38% | 80 |

*Task counts are gauge.

What is the hardest section of the CPA Exam?

Every candidate is going to bring his or her own background and skills to the exam, then each candidate's feel will be different.

That said, FAR is the department that usually causes candidates the most trouble. And with nearly 200 Representative Tasks, the breadth of FAR will require you to larn the almost information in order to be prepared.

Tested skill levels

While memorization may take been plenty for passing CPA Exam versions in the by, the modern CPA Exam expects more than from candidates. The current exam version will hogtie yous to attain a greater comprehension of accounting topics by featuring questions that assess you for college levels of knowledge and skill.

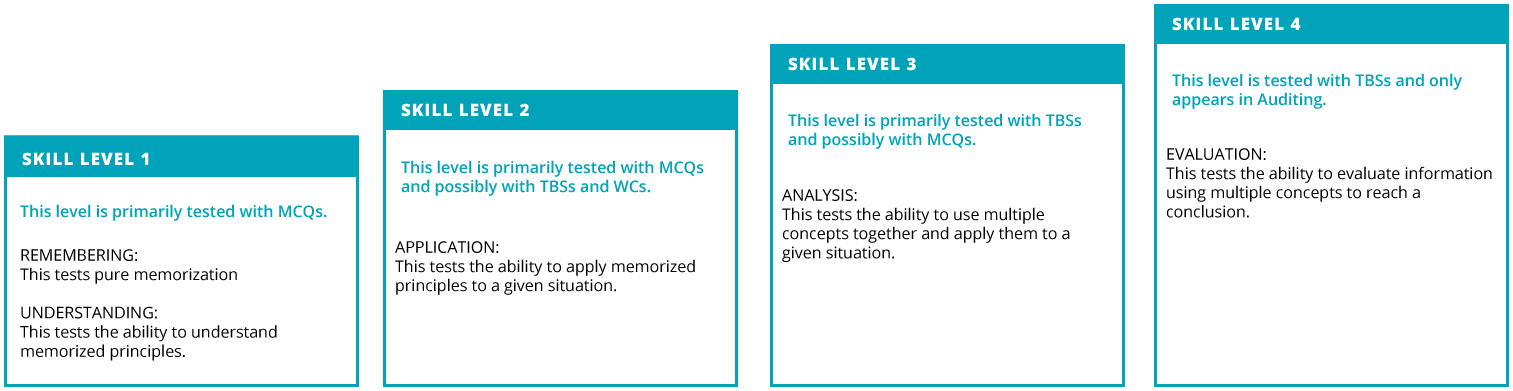

The CPA Exam Pattern, an outline of the topics that can appear on the CPA Exam, includes representative tasks that the AICPA has determined are critical for newly licensed CPAs to understand. The CPA Test incorporates these tasks into its questions, and the AICPA has assigned ane of the following four skill levels to each of the tasks.

Remembering and Understanding requires the lowest amount of skill, while Evaluation requires the highest amount.

To reach the Analysis and Evaluation levels, yous must answer the "then what" questions: explicate why something is of import or not important. CPA Exam questions that ask you to reconcile, conclude, or evaluate scenarios address the higher skill levels.

Sample CPA Exam questions

These CPA Exam sample questions demonstrate some of the range in difficulty that these skill levels test.

Only AUD will examination you lot at the Evaluation level, but all of the examination sections will test y'all at the Analysis level.

While each section of the CPA Test has its own content areas and topics, they are divided into similar testlets. The 5 testlets are made upwardly of multiple-choice questions and task-based simulations. BEC contains written communications in addition to task-based simulations.

| Section | Remembering and Understanding | Application | Analysis | Evaluation |

|---|---|---|---|---|

| AUD | 30%-xl% | 30%-40% | 15%-25% | v%-15% |

| BEC | 15%-25% | 50%-60%* | twenty%-30% | – |

| FAR | 10%-xx% | 50%-sixty% | 25%-35% | – |

| REG | 25%-35% | 35%-45% | 25%-35% | – |

*Includes written advice

Different types of questions

The AICPA uses different types of questions to test its material. To ensure your success on the CPA Exam, y'all'll need to have experience with each type of question prior to sitting for the exam.

Multiple-choice questions (MCQs)

On the CPA Examination, multiple-selection questions contain a question stem and four answer choices. Three of the answer choices are known asdistractors. These are tricky considering they are based on common errors or misconceptions. The correct answer will be the all-time response to the question stem.

Job-based simulations (TBSs)

Job-based simulations are designed to mimic common tasks that accountants face. These include preparing journal entries, correcting memos or emails, researching regulations and laws, and collecting data from unlike sources.

Many TBSs will require you to utilise unlike exhibits provided in the simulation to collect the data needed to consummate a given chore.

THE SOLUTION

Gleim CPA Review ensures you will face no surprises on exam mean solar day. With 10,000 multiple-pick questions modeled after actual AICPA questions and with over ane,300 simulations merely like those yous'll run into on the examination, you lot tin be certain that yous'll be well prepared for fifty-fifty the most hard questions on the CPA Exam.

Written communications (WCs)

Completing a written communication involves writing a response to a scenario in the form of a business memo that addresses the needs and concerns of the designated party in the manner that a CPA in the field would do. These tasks are graded on writing skill as well as the content and legality of your answer.

At first glance, WCs may seem intimidating, but successful candidates report that these questions are adequately straightforward to answer. The central is managing your time on the exam and ensuring y'all have enough of it when you get to this testlet.

Since only the final testlet of BEC has WCs, you'll need to plan your fourth dimension allotment effectually the increased time these questions can require.

| Question Types on the CPA Exam | ||||

|---|---|---|---|---|

| Section | AUD | BEC | FAR | REG |

| Testlet 1 | 36 MCQs | 31 MCQs | 33 MCQs | 38 MCQs |

| Testlet 2 | three MCQs | 31 MCQs | 33 MCQs | 38 MCQs |

| Testlet 3 | ii TBSs | two TBSs | 2 TBSs | 2 TBSs |

| Testlet four | 3 TBSs | 2 TBSs | 3 TBSs | 3 TBSs |

| Testlet v | 3 TBSs | 3 WCs | 3 TBSs | 3 TBSs |

| Total MCQs | 72 | 62 | 66 | 76 |

| Total TBSs | viii | 4 | 8 | 8 |

| Total WCs | 0 | three | 0 | 0 |

What is the hardest type of question on the CPA Exam?

The task-based simulations are the well-nigh hard part of the exam for most candidates. These questions crave candidates to interpret data from multiple sources and complete multiple tasks using that data. Additionally, the fact that they come later both MCQ testlets means y'all're already well into your exam time and mental fatigue may accept begun to set up in.

How time makes the CPA Test hard

The CPA Exam has two time limits, and both affect the difficulty of the examination. The kickoff time limit you volition face is the 4-hour duration of each section's test. After you pass your first department, y'all'll encounter the second time limit: the 18 months your passing score remains valid for.

The first fourth dimension limit: beating the exam clock

When you sit for the CPA Examination, you'll see a pocket-sized countdown clock in the meridian-left corner of your screen.

Once you are through the five-minute introductory screens, your test volition begin and the timer volition begin to countdown from four hours.This countdown volition exist one of your greatest enemies during the exam. You accept to really manage your time well if y'all desire to finish within the allotted fourth dimension and pass the exam.

The longest test, REG, has 76 MCQs and 8 TBSs, and the shortest, BEC, has 62 MCQs, 4 TBSs, and 3 WCs.

Your task is to reply each of these questions to the best of your ability. But having a time limit means y'all'll need to prioritize answering every question over scrutinizing each question individually.

To make matters worse, during the CPA Examination, you will non be able to render to testlets once y'all accept completed them. It is vital to plan your time in each testlet because any extra fourth dimension y'all have at the terminate of the exam is wasted.

THE SOLUTION

Because the CPA Exam'south fourth dimension limit is not divided between testlets for you, information technology is important to programme your test time earlier you sit for the exam.

The Gleim Time Management Organisation sets fourth dimension goals for each testlet of the CPA Examination. By following our time allocation recommendations, you can ensure yous take enough time for each question in every testlet.

The second time limit: passing all 4 sections inside eighteen months

In one case you have passed your first section of the CPA Exam, a new timer begins counting down. Yous have 18 months to laissez passer the remaining three sections of the CPA Test; if you do non pass them all, you'll lose credit for the start section you passed.

This adds additional stress to every stage of your test procedure. Managing this stress, creating a study plan, and adjusting your plans for setbacks is part of passing the CPA Exam.

Time-management and projection management are central skills for accountants to possess. Past including multiple time limits on the CPA Exam, the AICPA tests your ability to manage time and maintain accuracy and focus.

THE SOLUTION

The CPA Exam's 18-month time limit makes it critical to plan ahead.

With Gleim's Study Planner and Personal Counselors, you lot'll accept the tools yous need to program your test schedule. An platonic schedule will be flexible enough for emergencies and additional hurdles—but firm plenty for goal setting.

Gleim'southward Personal Counselors have helped candidates pass over a meg CPA Exams, and so you can rely on their expertise.

What if I don't pass in eighteen months?

Within 18 months of passing your starting time CPA Exam section, you must accept passed all four sections or you will lose credit for that first section.Then, y'all must pass any remaining sections and any section(s) you lost credit for within xviii months of the oldest section you still accept credit for.

Case: On November 2, y'all have BEC and laissez passer. Later, y'all accept and laissez passer FAR on February 23, and REG on Apr iv. If you fail to pass AUD by May 1 the following year, yous volition lose credit for BEC, and on August 23, if you accept not even so passed AUD and re-passed your first BEC, you volition lose credit for FAR.

How long is the CPA Test?

The CPA Exam is made upwards of iv sections and each section includes four hours of testing time and one hour of fourth dimension for administration and security. The test is offered in multiple testing windows around the twelvemonth, and scores only remain valid for eighteen months.

In other words, the CPA Exam is a long examination, and this fourth dimension investment makes every aspect of it that much harder.

The fourth dimension invested into the CPA Examination will come in two primary chunks: studying for the exam and taking the exam.

Fourth dimension spent studying for the CPA Exam

Studying for the CPA Exam is a time-consuming procedure. Every candidate'due south experience will be different. We've seen candidates pass with as little as 80 hours of study time per section, and nosotros've seen others need 180. The study fourth dimension you demand tin can be influenced past factors such as how familiar you lot are with the material, how long it's been since you earned your degree, and how long ago you last studied for a serious test. Ultimately, planning your study schedule is just another aspect of the difficulty of the CPA Exam. If yous invest too little time, you risk poorly covering primal topics. Invest too much, and you could begin forgetting topics covered well-nigh the beginning of your studies.

How long does it take to pass the CPA Exam?

The average CPA candidate may need 6-12 months to pass the entire CPA Exam. This could vary depending on:

- How familiar you are with the material.

- How much fourth dimension has passed since you earned your degree.

- How many relevant skills you lot utilize in your day to day work.

- How much time yous have to study.

- How long you lot can concentrate in i sitting.

Testing windows

The CPA Test is offered in multiple testing periods, or windows. You will merely be able to sit for exam sections during the four annual testing windows, but yous tin can take more than one examination in any given window.

Each testing window includes the first two months of the quarter and the first 10 days of the 3rd month.

Q1 January 1 ‑ March 10

Q2 Apr 1 ‑ June ten

Q3 July 1 ‑ September 10

Q4 October one ‑ Dec x

Time spent taking the CPA Exam

You will likely spend more time taking the test than you imagined, one time you consider the additional time spent traveling, scheduling, and signing in.

Co-ordinate to Prometric's Candidate Bulletin, you volition need to arrive to the testing site 30 minutes before your appointment time. This time is spent verifying your identity and reviewing the testing center policies. If you lot practice non arrive at least 30 minutes prior to your scheduled fourth dimension, you may forgo your appointment and will receive no refund!

In addition, while the CPA Test is four hours, your appointment will be scheduled for four and a half hours to include fourth dimension for the survey and optional pause. Do non misfile this fourth dimension with the 30 minutes required by Prometric. With each examination taking five hours, the CPA Exam will crave a minimum of twenty hours of exam time!

Scheduling concerns for international candidates

If you lot're an international candidate, the travel time can be particularly difficult if the CPA Exam is non offered in your home country.

Information technology is not unheard of for international candidates to schedule all of their exams inside a week of each other in order to minimize what may otherwise exist 1 of the largest hurdles betwixt you and the CPA certification.

| CPA Exam Fourth dimension total 5 hours | |||||

|---|---|---|---|---|---|

| Prometric Sign-in | CPA Exam Introductory Screens | Testlets 1,2, & 3 | Break | Testlets iv & 5 | CPA Survey |

| 30 minutes | v minutes | 144 minutes | 15 minutes (optional) | 96 minutes | x minutes |

Betwixt this and any travel or adaptation fourth dimension that may exist required based on the testing middle of your choice, it is clear that time plays a pregnant role in test-24-hour interval stress.

We repeat:Time-management skills are vital to overcoming the CPA Examination!

How to shave off fourth dimension? Pass on the kickoff take!

The CPA Exam is a time-consuming exam, so information technology is important to make sure it only eats as much of your time as information technology absolutely has to. You will spend approximately 30 times every bit long studying for the exam as you will actually spend taking it, so it can be tempting to shave that study fourth dimension down to sit down for the exam faster.

Encounter the list below for some tips on how to and how Not to save fourth dimension on the CPA Exam.

CPA Test Time-Saving Tips

Spend most of your time on topics you're struggling with

Prepare aside time specifically to report—and set study objectives

Practice all of the question types

Employ the CPA Blueprint as a guide on study topics

Take the Exam when you lot are consistently scoring 80% on your practice tests

Completely ignore topics you're comfortable with

Program to report all day, every day

Memorize the individual questions

Ignore topics you don't think will be tested

Wait until you are scoring 100% on all of your practice tests

As you can run across from our tips, the key is to report smart. Under preparing will result in poor performance, and failure means more than time spent registering, traveling, and testing. Over preparing will swallow your time and can cause data to go dated every bit the CPA Examination changes.

Our biggest proffer is this: Notice a CPA review provider that will lighten the brunt of the CPA Exam. The time you spend deciphering exam blueprints, content areas, and representative tasks can exist improve spent studying the materials and passing the CPA Examination.

Why is the CPA Examination so hard?

At that place'southward no doubt the CPA Exam is difficult, simply this difficulty is by blueprint and thanks to three primary factors:

1. The history of the CPA Exam

2. The purpose of the CPA Exam

iii. Changes in the field of accounting

Understanding why this examination is and then difficult tin can assist motivate you to get through it.

History of the CPA Exam

When the AICPA was formed in 1957, the CPA Exam had already existed for 40 years.

The CPA Exam was originally designed in 1917 every bit a test for membership to the Institute of Public Accountants (the organization that would eventually get the AICPA). Prior to this exam, each state would issue its ain exam, a practice that many states continued until 1952 when the CPA Exam became the universal standard.

The exam has changed many times over the years. Originally, the 19.v-hr-long examination was administered in five sittings over 2 and a half days, just twice per yr. It wasn't until the paper-and-pencil exam was discontinued in 2004 that the exam began to look like it does today.

From the very beginning the CPA Exam needed to be hard because information technology served as the standard for what an accountant needed to know. In those days, passing the CPA Test might have been the only signifier accountants had to testify their mastery of accountancy!

Purpose of the CPA Exam

The CPA Exam has two primary purposes: to provide reasonable assurance of a candidate'due south skills and to retain the value of the CPA certification.

Providing balls of a candidate's skills will always be the most of import role of the CPA Exam, and accomplishing that task is the principal reason the CPA Exam is hard even today.

This requires that the CPA Test constantly adjust to new laws, regulations, and industry standards and continually button the difficulty of the exam to lucifer the expectations of companies and police makers.

Every time the AICPA updates the CPA Test, information technology has to ensure the content does the following:

•Measure professional competence in

◦ Auditing

◦ Business concern Law

◦ Revenue enhancement

◦ Bookkeeping

•Test related business skills to appraise your noesis and judgment

•Verify your agreement of professional responsibilities and ethics

In addition, the CPA Test's difficulty ensures that it continues to be the gold-standard for accountants. The exam's difficulty is one of the reasons why the certification is sought later past and so many aspiring accountants.

It's besides why CPAs brand ten-15% higher salaries than non-certified accountants.

Changes in the field of bookkeeping

The modern economic system has inverse the expectations and responsibilities of accountants. The ability to interpret and use laws and regulations has go an expected and crucial part of the accounting profession. As a effect, the CPA Test must continually adapt to include the new and higher standards demanded of accountants.

Yep, the CPA Exam is hard. But that doesn't mean yous can't pass it!

Understanding the difficulty lets you programme means to overcome the hurdles and gives you perspective on the skills that the AICPA considers virtually valuable in the modern CPA candidate: excellent time- and project-direction skills, a thorough understanding of accounting, and the ability to communicate and utilize knowledge and experience.

Gleim is here to help. Read more most the features and tools that Gleim offers at our CPA Examination Resource Center and start your journey to passing the CPA Exam today!

CPA Exam Frequently Asked Questions (FAQs)

These FAQs will provide you with answers to the virtually mutual questions related to the Uniform CPA Examination®. You tin can as well find information about applications, accommodations, eligibility, Test credit, fees, jurisdictions, licensing, and other general administration topics on NASBA's CPA Central. For questions related to Exam scheduling and testing centers, you can visit the Prometric website. If you lot cannot find an answer to your question, contact the AICPA or NASBA directly.

Browse FAQs past topic:

- General Data

- Exam Content

- CPA Exam Sample Tests

- Exam Scoring

- Score Review and Entreatment

- International Testing

General Information

What is the Uniform CPA Examination® (Test)?

The Exam is a sixteen-60 minutes, iv-part assessment that you must pass in guild to qualify for a CPA license. It is designed to exam the minimum cognition and skills required of a CPA. The Exam is managed by three main partners:

- The AICPA develops, maintains, and scores the Exam

- The National Association of State Boards of Accountancy (NASBA) manages the National Candidate Database

- Prometric is the visitor that delivers the Exam at its authorized exam centers

The Exam is provided on behalf of Boards of Accountancy, which issue CPA licenses.

Where can I have the Exam?

You can take the Exam at authorized Prometric examination centers throughout the 55 U.S. jurisdictions equally well as select international locations. Meet "International FAQs" for testing countries.

Is the Test available in a language other than English?

No. Yous must take the Test in English language.

Is there a fourth dimension limit for passing the Exam?

You must laissez passer all four sections of the Test within 18 months. The calculation of when the 18-month timeframe begins varies past jurisdiction. Check with your specific Lath of Accountancy for details.

What are the requirements to take the Exam?

Exam requirements depend upon the jurisdiction where yous choose to become licensed. You can discover details past referring to your specific Board of Accountancy.

How much does information technology cost to have the Exam?

Exam fees depend upon the jurisdiction where you choose to become licensed. Yous tin observe details by referring to your specific Board of Accountancy.

How do I apply for the Exam?

You must outset decide on the jurisdiction to which you will apply. Later selecting your jurisdiction, y'all can obtain application materials and submit your completed applications as directed.

Is in that location i central organization where can I apply to have the Exam?

No. You tin take the Exam (and qualify as a CPA) only if you meet the requirements of a Board of Accountancy in one of the 55 U.S. jurisdictions.

What is the structure and format of the Exam?

Review the Exam Structure to acquire more than about the number and types of questions in each section, breaks, testing fourth dimension and other related topics.

Will I take the aforementioned Exam as other candidates?

You volition take a different but equivalent Test. The questions presented to you lot are drawn from a pool of test questions according to defined specifications. Although you lot take different Exams, the specifications ensure that the results are comparable.

Are some administrations of the Exam more difficult than others?

There may be pocket-sized differences among unlike administrations just these differences are deemed for during scoring. The AICPA enhances test security past creating multiple forms of the Exam with different questions for different administrations. Each form is comparable simply not identical.

Groovy care is taken to match the forms in terms of content and detail difficulty. Remember, you may be given questions of varying difficulty depending on your performance. Question difficulty is accounted for during scoring. Therefore, it does not mean that it is easier to get a higher score only because you receive easier questions.

What computer skills do I demand to take the Exam?

You but demand basic computer skills to take the Test. You are expected to be familiar with the use of a mouse and keyboard, and with basic spreadsheet and word processing functions. You must also be able to use a four-office online calculator.

In order to respond to Examination questions, you may demand to:

- Select a response from available options by clicking on a radio button

- Perform standard financial calculations utilizing a Microsoft® Excel spreadsheet or iv-function online computer

- Type a memorandum or letter in the written communication tasks

- Perform an Authoritative Literature search in the research portion of simulations

- Copy and paste text using the standard shortcut keys

- Use scrollbars

- Resize or movement windows

- Highlight excerpts in exhibits that you lot would similar to remember

To learn more about the Test's functionality, cheque out the sample tests and the help tool in the sample tests for tutorial topics.

Does the Exam use Microsoft® Word and Microsoft® Excel?

You lot will accept access to a version of Excel with certain functions unavailable. You volition not be tested on your ability to use Excel. The program is bachelor only as a tool to utilise during the Exam. The Test uses a discussion processing awarding that is like just not identical to Word.

To learn more most the Exam'southward functionality, cheque out the sample tests and the "Assistance" tool in the sample tests for tutorial topics.

Can I take the Test on newspaper?

No. This is a computer-based Examination.

Back to top

Test Content

What topics are tested on the Exam?

You can notice each Exam section's topics in the CPA Exam Blueprints. The Blueprints show yous the content allocation, skill and score weighting, and references. They also provide representative tasks for the content areas.

What are the rules for new bookkeeping and auditing pronouncements?

Y'all can find the Policy on New Pronouncements in the Examination Study Materials section.

What informational materials/databases are bachelor to me during the Exam?

For all simulations, y'all have admission to Authoritative Literature, which includes some sections of the AICPA Professional Standards (in the Auditing and Attestation section), FASB Codified (in the Financial Bookkeeping and Reporting section) and Tax Code (in the Regulation section).

Dorsum to top

Examination Sample Tests

What are the sample tests?

The sample tests let you do with the format and functionality of the Exam as it volition announced in a Prometric test center so that you are prepared prior to your test mean solar day. There is one sample exam for each of the four sections of the Exam. No live content is used in the sample tests. Although an answer key is provided, you should not consider right answers reflective of your readiness to take the Exam.

What is included in the sample test?

The sample tests include 2 multiple-choice testlets and 3 job-based simulation testlets for each of the 3 sections of the Exam: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Regulation (REG). The Business Environment and Concepts (BEC) section of the Exam sample test includes 2 multiple-choice testlets, ii task-based simulation testlets and one written communication testlet. You will too accept access to tutorial topics found by selecting the "Help" button in each sample test.

What kind of computer practice I demand to use the sample tests?

Sample tests are web-based and crave an Internet connexion. They will work on most devices and operating systems. Yous should employ a 23-inch Hard disk drive (1920×1080) monitor for an feel similar to an actual test center.

The sample tests are optimized for Microsoft® Internet Explorer xi, which is used in the Prometric centers. Our testing shows that it besides works well in Microsoft® Edge, Google Chrome, and Mozilla Firefox. We do not recommend Apple Safari at this time.

Since the Exam software uses high-definition (HD) monitors, exercise I need an Hard disk monitor to practice with the sample tests?

No. Nonetheless, if you want a realistic picture show of how the text volition appear in a Prometric test center, we recommend using an Hd monitor.

Why do I meet scrollbars on the right or bottom when I view the sample tests?

The sample tests can run on monitors with less than the minimum suggested resolution. If you practice, you will run into scroll bars.

You can eliminate the scrollbars on monitors with less than the suggested resolution by using the browser zoom shortcut keys:

- PC: Ctrl-[minus sign] and Ctrl-[plus sign]

- Mac: Command-[minus sign] and Command-[plus sign]

Zooming out will resize the Exam to fit on your screen without scrollbars, but you may find that the smaller text is more difficult to read.

Will the mouse right-click button work when I test in Prometric test centers?

When taking a sample test, a context card appears when y'all click the right mouse button. It will allow you to copy, paste, and perform other operations. Note: This characteristic is not available at Prometric test centers.

What if I have problem running the sample test?

Brand sure that your device meets the minimum technical requirements. If you lot are still having trouble launching the sample tests, delight contact the AICPA for assistance.

Complete this survey to leave feedback near your sample test feel.

Back to peak

Exam Scoring

What is the passing score?

The passing score is 75 on a 0-99 calibration. Scores are non curved. Notice out how your score is adamant past reading most Exam Scoring.

Who sets the passing score for the Examination?

The passing score is determined by the AICPA Board of Examiners (BOE), which considers many factors, including standard-setting report results, historical trends, and Test content changes. The BOE also receives input from NASBA, consultant psychometricians, the academic community, and licensed CPAs. The passing score is the basis of the laissez passer or fail decision recommended to Boards of Accountancy on the informational score report.

Is scoring an automatic process?

Scoring is fully automated for all Exam components except the written communication tasks. Most written communication responses are scored by a estimator grading program, which is calibrated using human scorers. In some cases, responses are scored by a network of homo graders (all CPAs). If your score is close to the passing score, your written communication tasks volition be automatically re-graded by human graders. When at that place is more ane grader for a response, the boilerplate of the scores is used as the terminal class.

The AICPA uses Item Response Theory (IRT) for the objective portion of the Test. IRT is a well-established psychometric approach to scoring used by licensing and certification examinations that administrate many dissimilar test forms.

All scoring routines, whether automatic or not, are verified at various stages of the scoring procedure.

When are scores released?

Score release dates are posted hither.

How does the Exam test my cognition and skills?

The Test uses a multistage adaptive examination commitment model for all multiple-choice testlets. Your first testlet volition exist given at a level of moderate difficulty. The next testlet will be the same level or slightly more than difficult based on your performance. The adaptive model is non used for task-based simulations or written communication tasks.

Is multistage testing fair? Why are yous using it?

Yeah, it is fair. Since the characteristics of the examination questions are taken into account in the scoring, there is no advantage or disadvantage to beingness assigned testlets of unlike difficulty. The AICPA uses multi-stage testing because the test questions are matched to proficiency levels, and therefore fewer questions are needed to obtain authentic estimates of proficiency.

How do y'all decide which questions are difficult and which are medium?

The difficulty levels of the test questions (and other statistics that are used to draw each test question) are determined through statistical assay of candidate responses. At the question level, difficulty is not quantified equally a category (east.k., moderate or difficult), just as a numeric value along a scale. Testlets are classified as either medium or difficult based on the boilerplate difficulty of the questions inside that testlet. All testlets take questions ranging in difficulty. Questions in difficult testlets only accept a higher average level of difficulty than those in medium testlets.

What are pretest questions and are they scored?

Pretest questions are included in every Exam (they may be multiple-selection questions, task-based simulations, or written communication tasks) only for the purpose of collecting information. The data are needed to assess the quality of the questions, and to collect scoring information for subsequently use when the questions become operational items. They are non part of your score adding.

Are scoring adjustments fabricated for candidates who feel difficulties during testing?

No. Your results are scored using the same process and method to ensure uniformity and the validity of the laissez passer or fail decision. In the rare instances when serious technical bug occur during testing, NASBA may offering y'all a free retest.

Can I get a passing score by only doing well on the multiple-pick questions?

No. Your results are scored using the same process and method to ensure uniformity and the validity of the laissez passer or neglect determination.

Back to summit

Score Review and Appeal

What is score review?

The score review procedure involves making sure that the approved answer keys were used and applied correctly in determining a candidate's score and is not an opportunity to have alternating responses considered. It is simply an additional independent verification of your Exam score. Please go on in mind that all scores undergo thorough quality control checks before they are released.

Given all the quality control reviews already completed, it is highly unlikely that your score will change due to a score review.

How and when should I request a score review?

You lot can contact your Board of Accountancy, or its designated agent, for instructions on requesting a score review, required fees, and meeting the score review asking deadline. If yous apply after the deadline engagement, your request volition non be processed. The option to utilise for a score review is available merely for a short flow of time later on your score has been reported to you. It may take upwardly to eight weeks for the score review to be processed and released.

How will the score review results be communicated?

Later on NASBA submits your asking to the AICPA, the AICPA reviews your score and reports the effect through NASBA to your Board of Accountancy, or its designee. NASBA, the board, or its designee, volition then transmit the result to you.

What is an appeal?

In the jurisdictions that allow appeals, the procedure provides y'all with the opportunity to appeal a declining score. Where bachelor, the appeal option enables you to view the multiple-option test questions or objective simulation problems that you answered incorrectly together with their responses, and to submit comments online. The entreatment does not include the written communication tasks.

The confidentiality of the Examination requires that such viewing sessions take place only in authorized locations, under highly secure atmospheric condition, and in the presence of a representative of your Lath of Accountancy or its designee.

Why should I consider requesting an entreatment?

You should consider requesting an appeal only if you want to review your incorrect responses because you believe that there is a question or simulation problem that you would like to challenge.

When you review the questions or simulation problems that you have answered incorrectly, you may determine to challenge the validity of one or more items. If you decide to do so, yous must exist prepared to present a cogent, vigorous, and compelling defense of your incorrect responses.

Please note that you lot will non exist able to submit new responses during an appeal. Nonetheless, you volition have the opportunity to challenge multiple-choice exam question(s) or simulation(s) and defend the response(southward) you provided at the examination.

How do I request an appeal?

Contact your Board of Accountancy, or its designee, to determine whether the entreatment option is available in your jurisdiction.

What is the fee for an entreatment?

You should contact your Lath of Accountancy, or its designee, for the exact amounts of these fees. You will be charged a separate fee for each item (multiple-choice examination question or simulation trouble) that y'all determine to challenge.

How will my entreatment be processed and the event exist communicated to me?

If your Lath of Accountancy determines that you qualify for an appeal, the board will submit your asking to the AICPA through NASBA. The board, or its designee, volition schedule your viewing session for you. Your online comments during this session volition be transmitted to the AICPA through NASBA.

After the session, the AICPA will review your responses on the section you are highly-seasoned, consider the online comments you submitted, verify your score, and forwards the result to NASBA. (Note: Y'all will not receive detailed information about the question(s) yous challenge because of the need to preserve the confidentiality of Exam content.) NASBA will report the result to your board, or its designee, and the result volition be transmitted to yous.

Back to top

International Testing

What is international testing?

International testing allows U.Due south. citizens equally well as eligible international candidates to take the Uniform CPA Examination® (Exam) in select countries. If you're a not-U.S. citizen, this process allows you to pocketbook the U.South. CPA license. The AICPA, NASBA and Prometric provide the aforementioned services for international testing as they do for U.S.-based testing. The Exam and licensure process is the aforementioned for international candidates as it is for candidates within U.S. jurisdictions.

If I'm not a U.South. citizen, how do I know if I'g eligible to accept the Test?

The NASBA website provides information for international candidates. Y'all might also consider using NASBA's International Evaluation Services. Contact NASBA for international candidate requirements.

When tin I test internationally?

Testing windows* for international candidates are the same equally those for U.South. candidates

How practise I schedule my Exam at an international testing location?

One time you lot consummate the international registration procedure, visit the Prometric website to schedule your Exam.

Where can I examination internationally?

Eligible international candidates tin can accept the Exam at Prometric testing centers in Bahrain, Brazil, England, Frg, India, Ireland, Nippon, Kuwait, Lebanon, Scotland and the United Arab Emirates (UAE). To determine if you can have the Test in 1 of these countries, review the specific FAQ below.

Who can take the Exam in Japan?

If you are a citizen or resident of Japan or the U.S., y'all can have the Examination in Japan.

Who tin take the Examination in India?

If y'all are a citizen or resident of India, Bhutan, Bangladesh, Myanmar, Maldives, Nepal, Sri Lanka, or the U.S., y'all tin take the Exam in India.

Note: Initially, testing will merely be offered in June and September 2020.

Who tin take the Exam in Bahrain, Kuwait, Lebanese republic and the United Arab Emirates (UAE)?

If yous are a citizen or resident of whatever of the following countries, you can take the Exam in Bahrain, Kuwait, Lebanon and the United Arab Emirates (UAE):

- Bahrain

- Egypt

- Bharat

- Jordan

- State of kuwait

- Lebanon

- Oman

- Qatar

- Saudi arabia

- UAE

- U.Due south.

- Yemen

Who tin can have the Exam in Brazil?

If you are a denizen or resident of any of the post-obit countries, you lot tin can take the Exam in Brazil:

- Argentina

- Antigua/Barbuda

- Commonwealth of the bahamas

- Barbados

- Belize

- Bolivia

- Brazil

- Cayman Islands

- Chile

- Colombia

- Costa Rica

- Domenica

- Dominican Republic

- Republic of ecuador

- El Salvador

- French Guiana

- Guatemala

- Grenada

- Guyana

- Haiti

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Paraguay

- Republic of peru

- St. Kitts/Nevis

- St. Lucia

- St. Vincent/Grenadines

- Suriname

- Trinidad & Tobago

- Uruguay

- U.Due south.

- Venezuela

Who tin exam in England, Germany, Ireland and Scotland?

Any eligible CPA candidate tin take the Exam in these countries.

Can I take the Exam if I'chiliad a resident of an international testing country just practise not have a passport?

No. Y'all must present your passport as a primary grade of identification. This includes U.S. citizens living abroad.

I am a citizen of a country that has international testing. I have been granted eligibility by a Board of Accountancy to sit for the Exam, yet according to your policy, I am unable to examination internationally and must travel to the U.Southward. If I'g eligible, why can't I test anywhere I want to?

The AICPA, NASBA, and Prometric operate testing centers nether the strictest of security measures, guarantee data integrity and security, and protect candidates' privacy. The 3 Exam partners decided that citizenship and residency requirements, and the integrity of certain kinds of proof of identification, provide a needed layer of security and allow us to improve serve Exam candidates.

How practice you make up one's mind international testing locations?

International testing locations are evaluated based on a set of criteria, including:

- Demand volume for the Exam from candidates in those countries

- Ability to deliver the Examination without legal obstacles

- Security threat to the Test (both physical security and intellectual property security) assessed at levels equal to those presented domestically

- Existence of established Prometric test centers

Countries that do non meet these criteria to the combined satisfaction of NASBA, the AICPA and Prometric are not considered as testing locations. We appreciate the want for boosted international testing locations and regularly review new locations for possible expansion.

Where tin I examination if my jurisdiction doesn't participate in international testing?

If yous register through a non-participating jurisdiction, y'all tin take the Exam only at approved testing centers in the U.South., Guam, Puerto Rico, or the Virgin Islands. Please check with NASBA to see if your jurisdiction participates in the international program.

Where can I apply for International testing?

Please visit the NASBA website for application information.

Can I use my international Discover to Schedule (NTS) to schedule at a U.Southward. test site?

No. Once you get an NTS for i of the international testing centers, it cannot be interchanged with an NTS for any of the U.South. testing centers. You must notify NASBA to change back to a domestic NTS.

Can I apply for a refund or an extension of my present NTS in guild to schedule at one of the international test sites?

There is no provision for withdrawing from the Exam and/or requesting an extension of your current NTS. Awarding and/or Exam fees are not refundable. If your NTS expires prior to taking the Exam, or y'all miss a scheduled testing appointment, you will not be able to reschedule or receive a refund on any of the fees paid. You will have to reapply for the Examination and pay the appropriate application/registration and fees.

If I test internationally, when will I get my scores?

Please review the score release dates for details.

Where can I detect additional international testing information when it becomes available?

The AICPA provides information through Exam Announcements and also updates these International FAQs when new information is available. You tin also notice information on the NASBA website.

Source: https://collegelearners.com/how-many-times-can-you-take-the-cpa-exam/

Post a Comment for "How Many Times Can You Take the Cpa Exam"